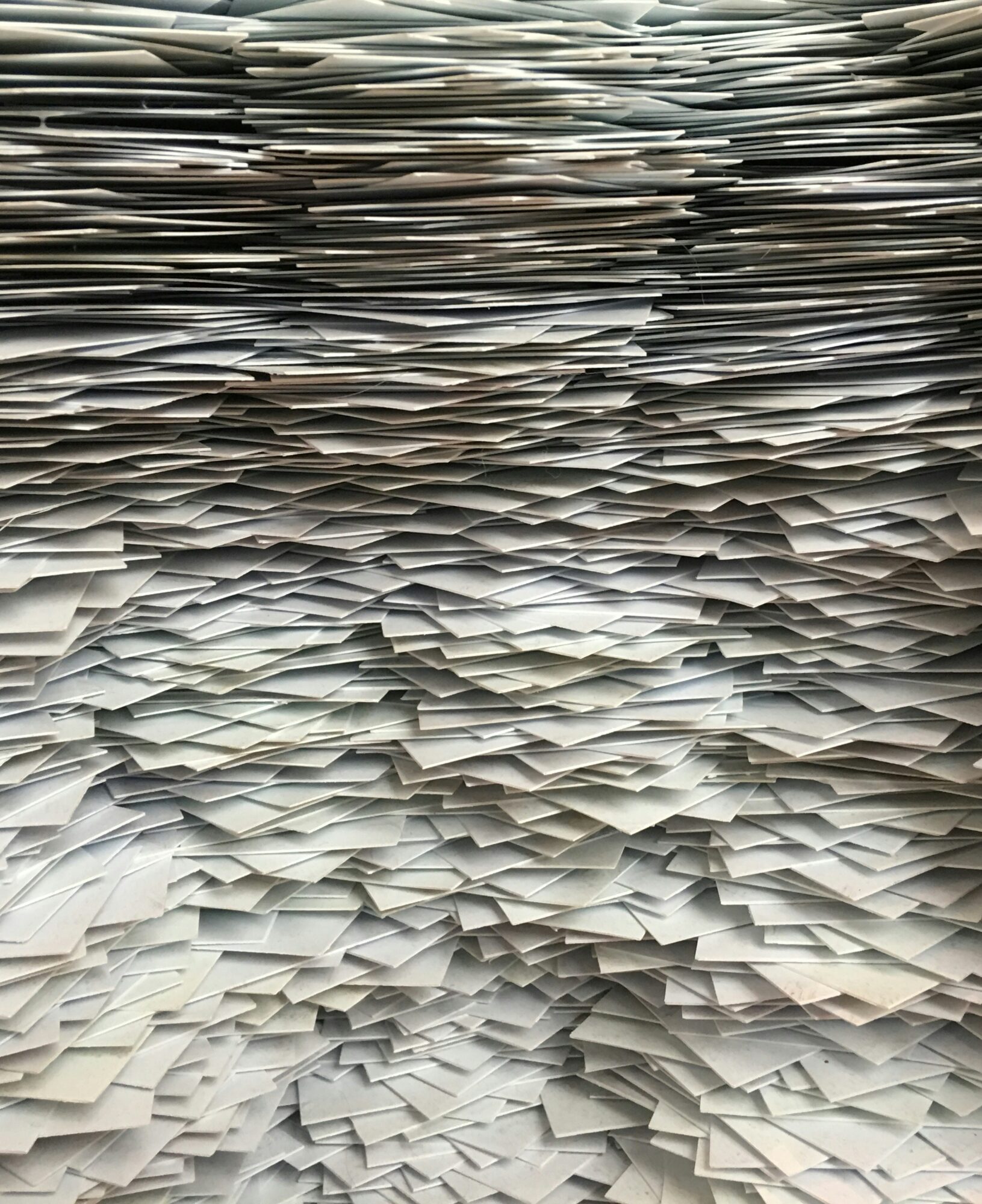

Information overload

24.07.2024 – Articles

“1,600 questions and all in different formats; it’s killing us.”

Many will recognise the unattributed quote above. LP demand for information is soaring and for most GPs, responding to the deluge of requests has become insurmountable.

While the LP hankering for increasingly granular information has been growing in recent years, with the rise of ESG and diversity pushes opening up new reporting streams, the slowdown in exits has made this particular thirst seemingly unquenchable.

Longer hold periods and volatile economic conditions are understandably leading LPs to probe deeper into more detailed performance information at the portfolio company level as well as wanting to understand the impact on growth drivers and margin expansion.

The current environment means investors naturally move to a risk-off position. LPs are not immune to this but, given the long-term nature of alternatives investing, instead of selling off fund interests at current market discounts, intense scrutiny of exposures, loss ratios and ownership breakdowns become an important tool for managing risk and expectations.