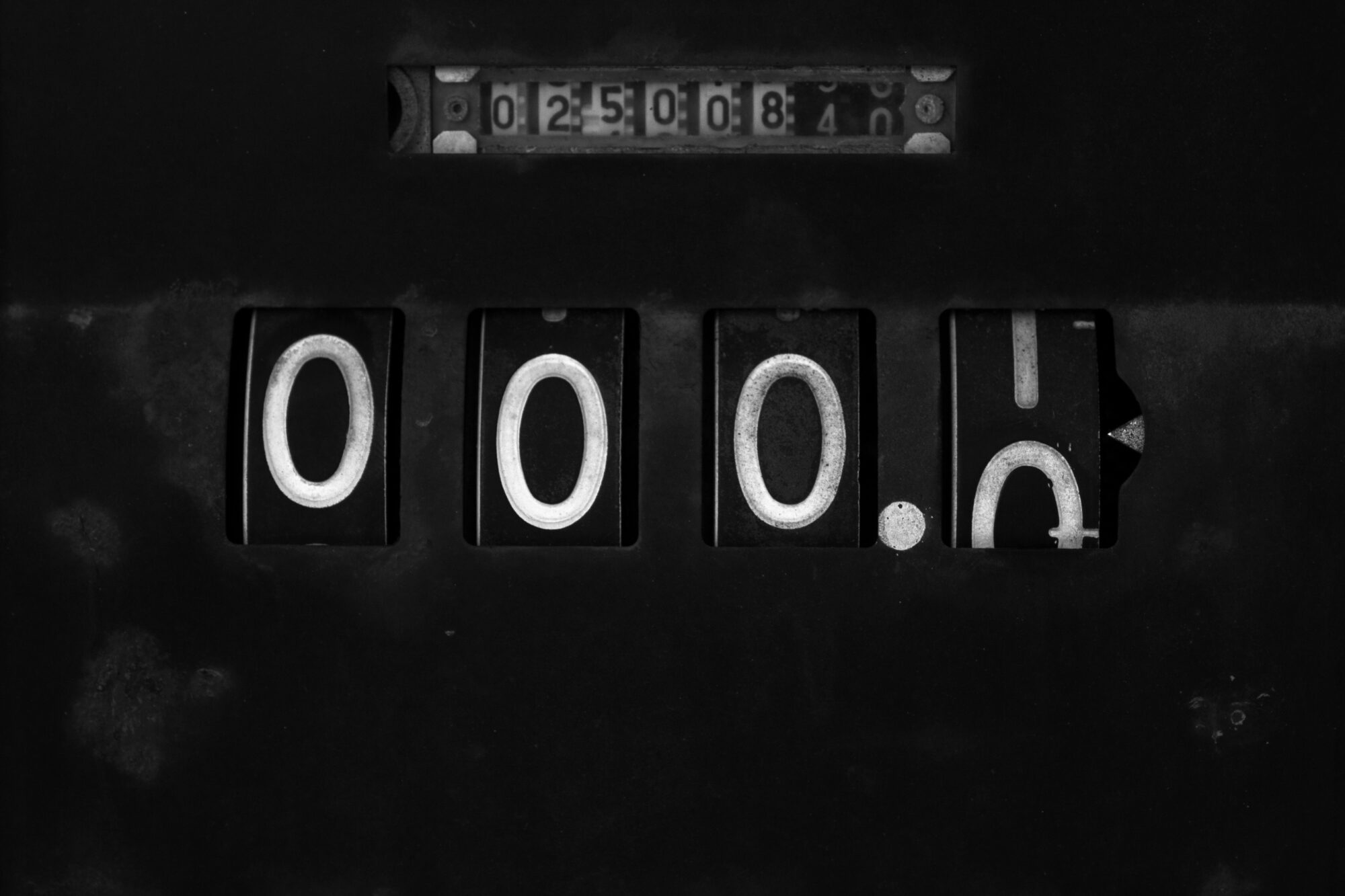

Zero Lux given

23.10.2024 – Articles

Just as the UK looks to increase the tax rate on carried interest, Luxembourg has moved to attract talent with some major incentives.

According to participants at the recent ALFI London conference

It is believed that there will be a modest increase in the current capital gains rate on carried interest in the UK.

It was highlighted that Labour used the term ‘carry loophole’ and ‘performance bonus’ to describe the current state of affairs. And that the same debate has been taking place across Europe.

Therefore, to argue that carried interest is a gain from investment and not employment there will likely be a co-investment requirement.